Introduction

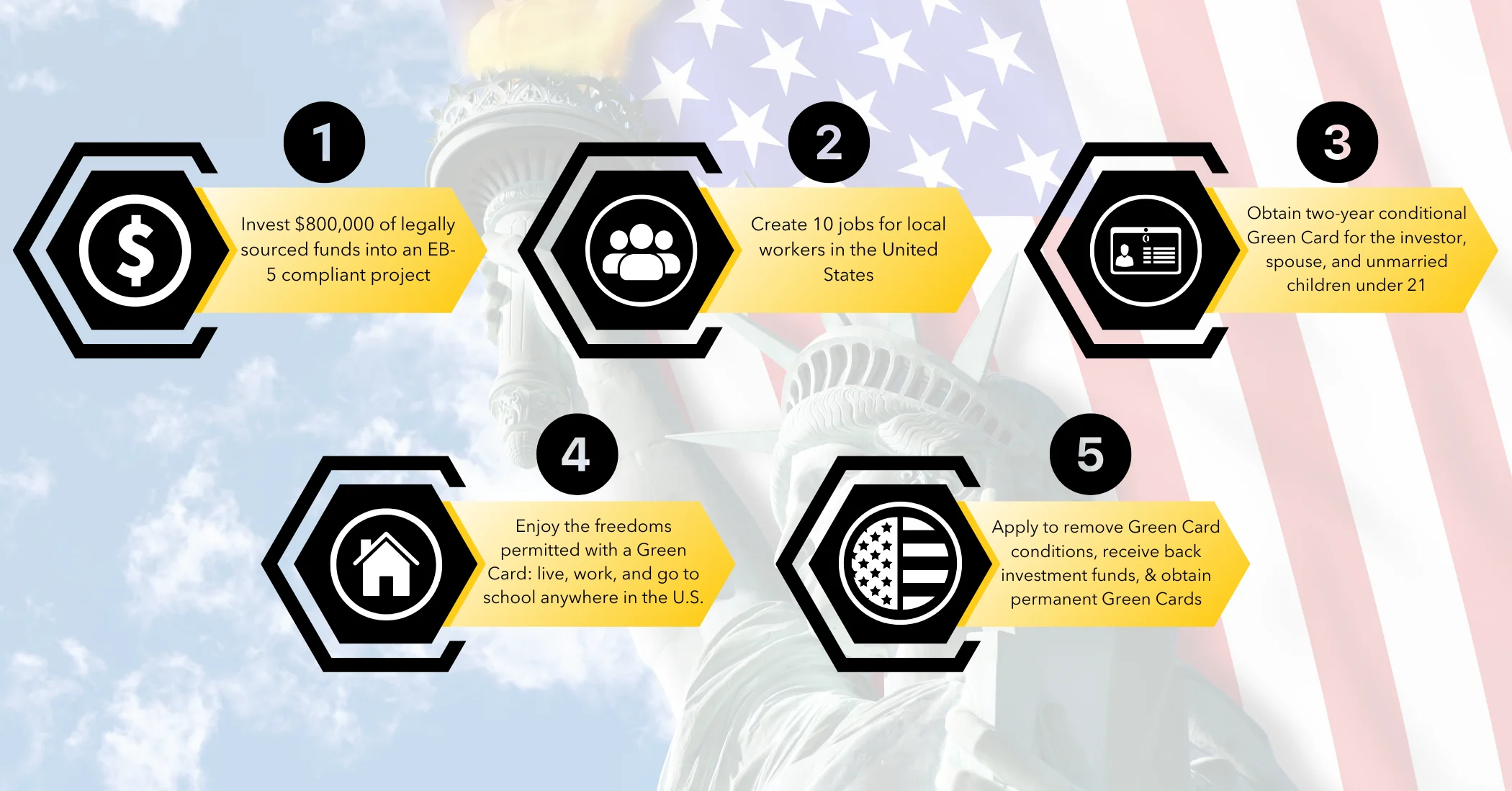

For foreign investors dreaming of a new life in the United States, the EB-5 Immigrant Investor Program offers a compelling pathway to permanent residency. However, navigating the complex landscape of immigration law, investment structures, and compliance requirements can be daunting. This is where specialized partners step in. These entities, often serving as the bridge between your capital and a qualifying project, are essential to your success.

Choosing the right partner is perhaps the most critical decision an investor will make. The difference between a smooth immigration journey and a stalled application often comes down to the expertise and integrity of the EB5 companies you choose to work with. These firms do more than just handle paperwork; they curate investment opportunities, manage compliance with the United States Citizenship and Immigration Services (USCIS), and safeguard your financial interests.

In this guide, we will explore the ecosystem of these vital organizations. We will define their roles, examine the services they provide, and offer actionable advice on how to vet them properly. By understanding the players involved, you can make informed decisions that protect both your capital and your family’s future in America.

What Are EB5 Companies?

At its core, the term “EB5 company” is a broad descriptor for the various professional entities that facilitate the EB-5 process. They exist to simplify the experience for foreign nationals who may not have deep knowledge of U.S. markets or legal statutes. While an individual can theoretically manage a direct investment themselves, the vast majority of applicants choose to work with established firms to mitigate risk.

These companies generally fall into three main categories:

Regional Centers

The most prominent type of entity is the USCIS-designated Regional Center. These organizations are authorized by the government to pool capital from multiple investors into large-scale projects. Their primary advantage is the ability to count indirect and induced jobs toward the job creation requirement, making it easier for investors to qualify for a Green Card. Regional centers are often the engines behind major real estate developments, infrastructure projects, and hospitality ventures across the country.

Consulting Firms

Specialized consulting firms act as advisors to investors. They do not typically manage the funds directly but offer guidance on project selection, source of funds documentation, and application strategy. They often work in tandem with immigration attorneys to ensure every aspect of the petition is watertight.

Investment Fund Managers

These are the financial architects. They structure the investment offerings, ensuring they meet both USCIS requirements and U.S. securities laws. Their role is to manage the flow of capital from the investor to the New Commercial Enterprise (NCE) and eventually to the Job Creating Entity (JCE), ensuring transparency and accountability throughout the investment lifecycle.

Top Services Offered by EB5 Companies

Partnering with professional firms grants investors access to a suite of services designed to streamline the immigration and investment process. These services cover everything from the initial project vetting to the final return of capital.

Project Selection and Due Diligence

One of the most valuable services provided is rigorous due diligence. Reputable firms spend months vetting potential projects before presenting them to investors. This involves analyzing the developer’s track record, the financial feasibility of the project, and the strength of the market. They ensure the project is located in a Targeted Employment Area (TEA) if applicable, which qualifies investors for a lower minimum investment amount. By filtering out high-risk ventures, they add a layer of security for the investor.

Immigration Support

The paperwork involved in an EB-5 application is extensive. These firms collaborate closely with immigration attorneys to prepare the I-526E petition (Immigrant Petition by Regional Center Investor). They help document the lawful source of funds—often the most scrutinized part of the application—and provide the necessary project documentation, such as the business plan and economic impact report. Later in the process, they assist with the I-829 petition to remove conditions on permanent residency by proving that the required jobs were created.

Investment Management

Once the capital is deployed, EB5 companies take on the role of asset managers. They monitor the construction progress and financial health of the project. Regular reports are issued to investors, detailing how the funds are being used and the status of job creation. This ongoing oversight is crucial for maintaining compliance with USCIS regulations and ensuring that the investment remains “at risk” as required by law, without being recklessly managed.

Legal and Financial Guidance

Navigating U.S. securities laws is complex. Professional firms ensure that investment offerings comply with the Securities and Exchange Commission (SEC) regulations. They provide offering memorandums that clearly outline the risks and terms of the investment. This transparency allows investors to understand exactly where their money is going and the timeline for potential repayment.

How to Choose the Right EB5 Company

With hundreds of regional centers and consulting firms in operation, selecting the right one requires careful research. Your Green Card and your capital are at stake, so this is not a decision to rush.

Track Record and Reputation

History matters. Look for firms with a long-standing presence in the industry. How many projects have they successfully funded? How many investors have received their permanent Green Cards through their projects? A company with a history of I-526E and I-829 approvals demonstrates that they understand how to navigate USCIS requirements effectively.

USCIS Approval and Compliance History

Verify the company’s standing with USCIS. Have they ever been issued a Notice of Intent to Terminate (NOIT)? Have they been involved in litigation or fraud allegations? The EB-5 Reform and Integrity Act of 2022 introduced stricter compliance measures, and reputable companies will be transparent about their adherence to these new rules, including integrity fund contributions and annual reporting.

Transparency and Communication

A trustworthy partner will be open about the risks involved. Avoid companies that guarantee returns or Green Cards, as these guarantees are violations of EB-5 rules. Instead, look for clear communication channels. Do they provide quarterly reports? Is their team accessible to answer questions? Transparency is the hallmark of a reliable partner.

Independent Reviews and Testimonials

Don’t rely solely on marketing materials. Seek out independent reviews and testimonials from past investors. If possible, speak to current clients about their experiences. Did the company deliver on its promises? Was the communication consistent? Real-world feedback is invaluable in assessing a company’s reliability.

Benefits of Partnering with Reputable EB5 Companies

While it is possible to pursue a direct EB-5 investment on your own, the benefits of working with established professionals are significant.

Increased Chances of Visa Approval: Experienced firms understand the nuances of USCIS adjudication trends. They structure projects to meet specific job creation buffers, ensuring that even if a project underperforms slightly, there are still enough jobs to support all investors’ visa petitions.

Access to Secure Opportunities: Top-tier firms have access to institutional-quality projects that individual investors would rarely find on their own. These might include partnerships with major hotel brands or government infrastructure developments that offer higher levels of financial security.

Expert Guidance: The immigration process can take years. Having a dedicated team to guide you through visa retrogression, policy changes, and consular processing removes much of the stress and uncertainty.

Peace of Mind: Knowing that a team of professionals is monitoring compliance, filing annual reports, and managing the asset allows you to focus on planning your life in the U.S. rather than worrying about the technicalities of your investment.

Challenges and Risks in Working with EB5 Companies

The EB-5 path is not without hurdles. The “at risk” requirement means capital can be lost if a project fails. To mitigate this, investors must engage in thorough financial planning. Before committing, it is wise to calculate loan eligibility to ensure your debt-to-income ratio remains healthy throughout the multi-year immigration timeline.

Identifying Trustworthy Partners: The sheer number of EB5 companies can be overwhelming. Some may prioritize their own profits over investor security. It can be challenging to distinguish between a slick marketing operation and a firm with genuine substance.

Understanding Complex Terms: Investment documents are filled with legal and financial jargon. Terms like “capital stack,” “senior loan,” and “equity waterfall” can be confusing. Without proper guidance, an investor might agree to terms that are unfavorable, such as long repayment periods or minimal returns.

Fraud and Non-Compliance: While rare among top firms, fraud does exist. The misappropriation of funds or failure to comply with securities laws can lead to total investment loss and visa denial. This highlights the importance of working with firms that undergo regular independent audits.

Project Delays: Even with honest partners, business risks remain. Construction delays, zoning issues, or economic downturns can impact job creation. If a project fails to complete, the immigration benefits may be jeopardized.

Mitigating the Risks: The best defense is knowledge. Conduct thorough due diligence. Hire an independent immigration attorney who represents you, not the project. Engage a financial advisor to review the investment documents. Never rush into a decision based on pressure sales tactics.

Future Trends in EB5 Companies

The EB-5 landscape is evolving rapidly, particularly following the legislative reforms of 2022. We are seeing a consolidation in the market, with smaller, less active regional centers closing down and larger, well-capitalized firms dominating the space.

There is a growing focus on Rural and Infrastructure Projects. Because the new law provides “set-aside” visas for these categories, companies are aggressively structuring deals in rural areas to attract investors from backlogged countries like China and India. This trend is reshaping where capital flows, moving it away from major metropolitan skylines toward varied developments in America’s heartland.

Transparency is also taking center stage. New integrity measures require stricter auditing and reporting. Investors can expect a higher standard of corporate governance from industry players, making the ecosystem safer and more professional than ever before.

FAQs About EB5 Companies

What is the role of EB5 companies in the visa process?

These companies facilitate the investment process by identifying qualifying projects, pooling investor capital, and ensuring that the project meets USCIS job creation and compliance standards. They bridge the gap between the investor’s funds and the immigration benefits.

How do I verify the credibility of an EB5 company?

You can verify credibility by checking their designation status on the USCIS website, reviewing their track record of project completions and repayments, and requesting audit reports. Consulting with an independent immigration attorney is also highly recommended.

What are the benefits of working with regional centers?

Regional centers allow investors to count indirect and induced jobs (jobs created by the project’s spending in the community) toward the visa requirement. This makes it significantly easier to meet the 10-job threshold compared to direct investments, which only count direct employees.

Are there risks in partnering with EB5 companies?

Yes. Risks include project failure, financial mismanagement, or regulatory non-compliance by the company. If the company fails to properly manage the investment or job creation, it can jeopardize the investor’s Green Card and capital.

How do EB5 companies ensure compliance with USCIS?

They ensure compliance by conducting regular economic impact analyses, filing annual reports (Form I-956G) with USCIS, maintaining detailed financial records, and adhering to the integrity measures outlined in the EB-5 Reform and Integrity Act of 2022.

Conclusion

The journey to U.S. residency is a marathon, not a sprint. The partners you choose to run this race with will determine your pace and your success. From regional centers to consulting experts, the ecosystem of professional firms is there to support you, but it requires active engagement and careful selection on your part.

By focusing on transparency, track record, and compliance, you can find a partner who aligns with your goals. Do not leave your American dream to chance—invest time in choosing the right team, and you will be well on your way to a secure future in the United States. If you are ready to take the next step, consult with a reputable immigration investment firm today to explore your options.